As we reach the halfway mark in the year, there’s

been no shortage of interesting developments in the European IT

channel. CONTEXT’s weekly webinar briefings are our opportunity to

bring you a condensed update of the most important market trends, so

that you can make better–informed business decisions. Among our

highlights this month are new trackers for AI PCs and servers, a new

government for the UK, and updates for the cybersecurity market.

Here’s our pick of the top stories in more detail:

The UK channel awaits a new government

The UK went to the polls on 4th July with the

expectation of a new Labour government coming to power. However, it

inherits tough economic conditions, with interest rates still at a

16–year high, feeding into a muted distribution market. Year–on–year

(YoY) revenue sales growth for May increased 0.6% and there was a

recovery in June so that the quarter ended up positive. We await

further input from the Chancellor on where government spending will be

directed after the review she is conducting in July.

More generally, the SMR channel continues to

perform well, with revenue growth up 2% year–on–year (YoY) year to

date (YTD). The e–tailer consumer channel is doing less well at –11%

annual growth YTD, although demand is slowly improving. Smartphones

have continued their strong growth in 2024, driven particularly by

Apple sales through the SMR channel (+38% YTD) and corporate channel

(33% YTD).

MSPs drive cybersecurity sales

The cybersecurity category is down –4.7%

year–on–year (YoY) year to date (YTD) due to a soft Q1, tough YoY

comparisons, and continued underperformance in the largest

distribution market of Germany. The UK is now the biggest market by

spend for cybersecurity in Europe, having recently returned to

positive growth after a tough start to the year (+2% YoY YTD). The

fastest growing segment at present is MSPs, up 12% YoY YTD and even

higher in the UK (25% YoY YTD) and Italy (26% YoY YTD). It’s also one

of the few bright spots in Germany, with sales via MSPs increasing 11%

YoY. Why the surge? Companies are recognising that it’s increasingly

cost–effective for them to allow a third party expert to handle all of

their security, including contract renewals and technical management.

Tracking the AI PC market

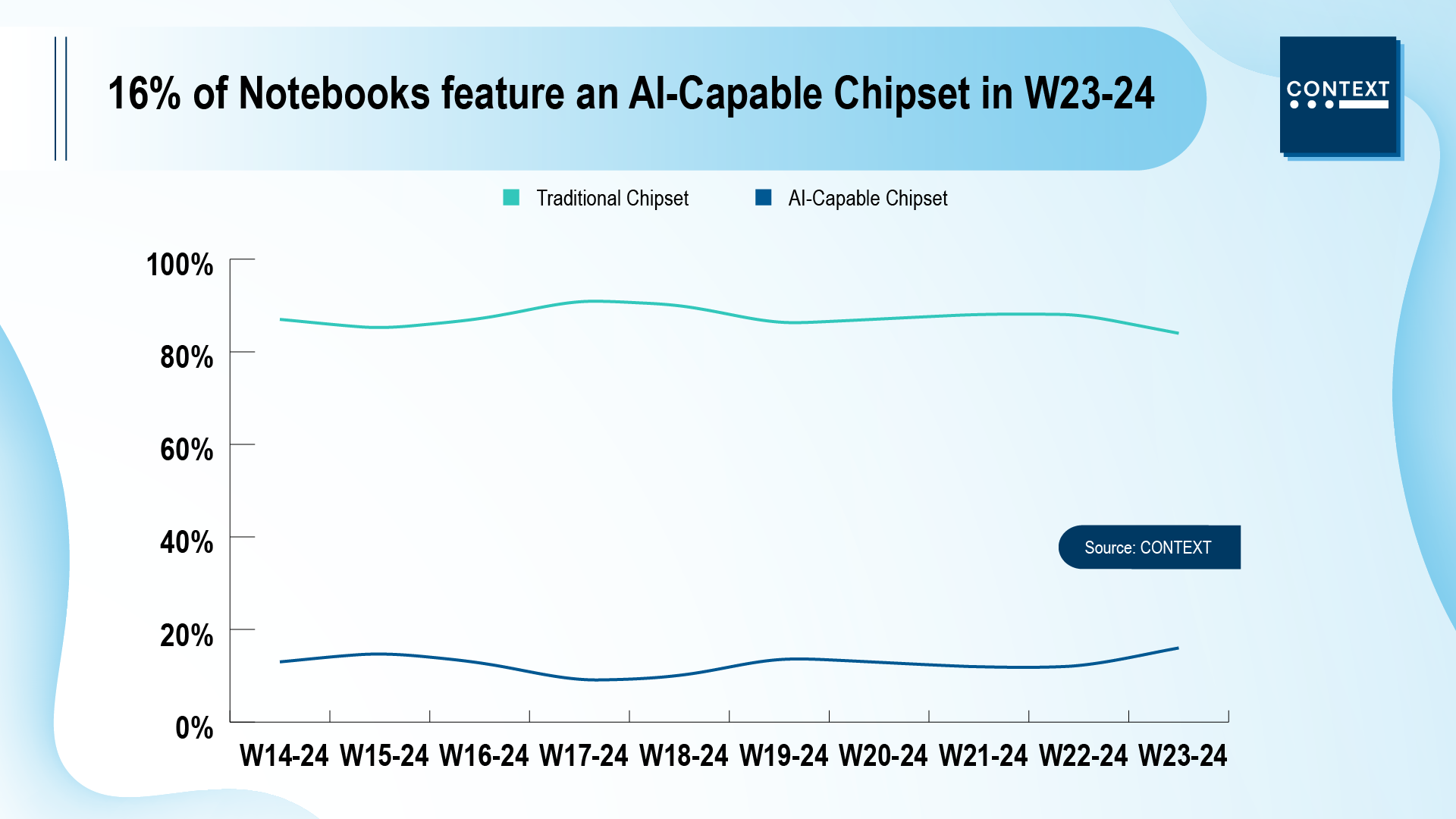

CONTEXT provided the first of its regular updates

charting the emerging AI PC space in June. It’s still early days for

the category, but there are high hopes that it will help to drive real

growth in the market. We’ve seen the launch of Qualcomm’s Snapdragon

X–chip and Microsoft’s new Copilot+ range. In the first and second

weeks of June (week 23 and 24) we saw AI notebooks hold a steady

market share of around 16%, with Qualcomm–based Copilot+ machines

making up 4.6% of AI–capable chipset notebook sales. However, more

launches are coming soon, and we’re excited to see what they will bring.

CONTEXT launches AI server tracker

The PC market isn’t the only one likely to be

impacted by AI technology. To see how the server space will evolve

over time, CONTEXT will be looking at the performance of GPU,

AI–oriented and AI–capable server products. That is, servers able to

house a certain number of GPUs and accelerators, and handle AI

workloads. The good news is that AI server revenues are up since the

middle of last year, and in early Q2 2024, they have an impressive

revenue market share of 15%. Although units sold are still quite low,

quarterly volumes are increasing, with AI servers taking 5% of the

volume market share in Q2 2024 so far. Watch this space as AI

investment drives infrastructure revenues across the European

distribution channel in 2024 and beyond.

To find out more, register for our

next weekly IT Industry Forum webinar by

completing the form below: