London, 16 April 2025 – At the start of 2025, vendors

were optimistic and anticipated a rebound in Industrial 3D printing

sales within the year. However, high inflation, high interest rates,

layoffs, uncertain Mergers & Acquisitions (M&A) activity,

tariff disputes and increasing concerns about looming recessions

dampened this outlook.

Results from the fourth quarter of 2024 revealed

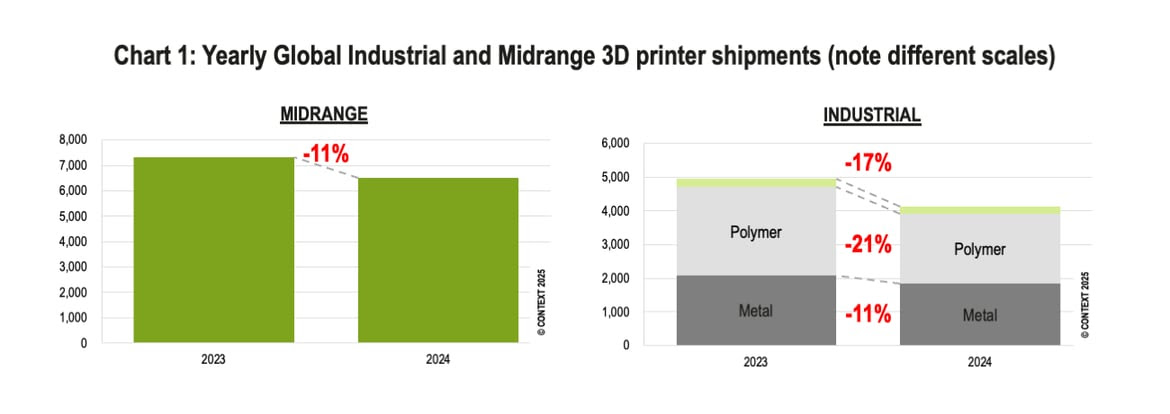

a downturn across all 3D printer sectors: sales of Industrial

($100,000+) printers declined by –6%, those of Midrange printers

(costing $20,000–$100,000) fell by –18%, and shipments of Professional

($2,500–$20,000) printers decreased by –11%. Even the previously

surging Entry–level segment experienced a –10% drop in global

shipments compared to the same period the previous year.

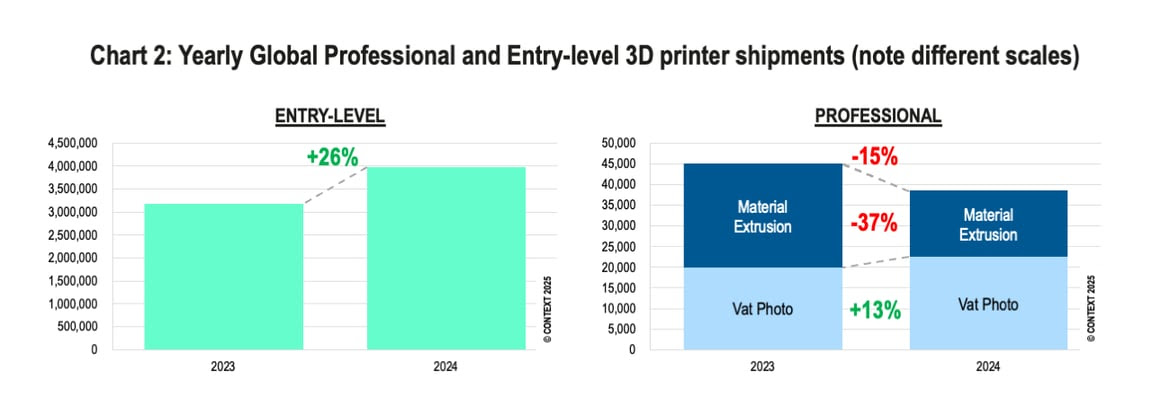

The year as a whole was challenging. Only the

Entry–level segment grew: shipments of printers priced below $2,500

were 26% up on 2023, driven by the emergence of brands like Bambu Lab

and the continued strength of market leader Creality. Although such

printers are primarily aimed at hobbyists, they have had an impact on

sales of Professional printers, which were –15% down on the previous

year (with some nuances). In 2024, global Midrange printer shipments

decreased by –11%, and sales of systems in the crucial Industrial

price class were –17% down on 2023.

2024 was a tough year across the globe for many

3D printer system vendors, marked by macroeconomic pressures and a

shifting competitive landscape. But beneath the surface, there’s a

clear sense of continued strong bottled–up demand that could reshape

the industry in 2025 and beyond.

Industrial systems

Industrial 3D printers underperformed woefully

against expectations in the quarter, with –6% fewer systems shipped in

Q4 2024 than in Q4 2023. While Industrial polymer printers bounced

back a bit, sales of Industrial metal printers were notably weaker

especially in China. Over the full year, global shipments of

Industrial additive manufacturing printer systems were down –17%: –21%

for polymer systems but only –11% for metals systems.

Industrial polymer systems

Global shipments of Industrial polymer systems

were up 10% in quarter (Q4 2024) thanks mainly to 23% YoY growth for

vat photopolymerisation systems. Demand in China bounced back:

shipments into the region were 53% higher than in Q4 2023, with most

of those coming from UnionTech. China was, once again, the top end

market and accounted for 34% of total global shipments. In the

second–largest region, North America (representing 29% of the

worldwide total), unit shipments dropped –14% YoY.

While the near–term period saw some marginal

growth not only in vat photo shipments, but also in polymer PBF

shipments (mostly from HP) and some in material jetting solutions

(mostly from Stratasys) the full–year was overall a quite difficult

year for Industrial polymer machine vendors as –21% fewer systems

were shipped worldwide in 2024 than in 2023. Shipments for all

categories of Industrial Polymer machines were down for the year:

vat photo –30%, PBF –6%, material extrusion –16% and material

jetting –10%.

Industrial metal systems

PBF systems accounted for 71% of all Industrial

metal printers shipped in Q4 2024 but unit shipments slid down –20%

YoY. Directed energy deposition (DED) saw its share increase to 17%

with a 15% rise in unit shipments – mostly thanks to the low–price

leader Meltio – but there was a YoY decline in shipments of systems

based on other technologies. After a very difficult third quarter,

China’s BLT regained its position as the top global vendor of metal

PBF printers (as measured by unit volumes) in Q4 2024, in spite of a

shipment drop of –11% YoY. In fact, all of the Top 5 vendors in this

sector were Chinese. Although the first half of 2024 was strong for

these companies, H2 2024 was more challenging and Q4 2024 was equally

weak for Western and Chinese manufacturers alike with unit shipments

of metal PBF systems down –22% and –20%, respectively.

From a revenue standpoint, the metal PBF sector

held up much better in Q4 2024, seeing only a –10% YoY decline. In

this regard, Western vendors fared better: EOS saw strong results and

Nikon SLM Solutions moved back into the global top spot as the company

with the highest revenues from Industrial metal PBF systems.

For the full year, the only sector in this

category seeing any shipment growth was DED (up 7% YoY): PBF

shipments were down –12%, those of material extrusion systems down

–29%, material jetting –18% and even metal binder jetting system

shipments were down –17% on the previous year. The only vendors

shipping more Industrial metal printers in 2024 than in 2023 were

Meltio, ZRapid Tech, Eplus3D and (marginally) TRUMPF. Overall system

revenues were down –11% but, thanks to rising demand for large

multi–laser systems, there was strong revenue growth for Nikon SLM

Solutions (29%) and Eplus3D (40%).

Midrange systems

Midrange printer shipments dropped –18% YoY in

total during Q4 2024. This was in spite of a 25% increase in sales of

material jetting systems that put this process ahead of all others.

While a few companies, including Stratasys, saw a YoY rise in

shipments of this type of machine, it was the 100% YoY growth of

Flashforge that catapulted the technology to the top spot. While

vendors like Stratasys attributed their growth to polymer systems and

strength in the dental market (particularly as the adoption of digital

dentures accelerates), Flashforge’s strength is in a wax–based

material jetting solution aimed primarily at the jewellery market.

Full–year shipments in this category dropped –11%

as eight of the Top 10 vendors shipped fewer printers in 2024 than in

2023. This was due mostly to declining sales in the category from

Western industry stalwarts Stratasys, 3D Systems, Formlabs and

Markforged, and because high–profile players like Nexa3D left the

market. Chinese companies, which mostly fulfil domestic demand, fared

much better with Flashforge and ZRapid Tech seeing full–year shipment

growth of +123% and +11%, respectively. Shipments to China grew by 5%,

enabling the country to edge out North America (where annual shipments

fell by –22%) to become the top region for Midrange printers in 2024.

Professional systems

The two sub–technologies in this price–class –

material extrusion and vat photopolymerisation – went in opposite

directions in 2024. In the fourth quarter, overall shipments in this

segment were down –11% on Q4 2023 but shipments of material extrusion

printers (generally FDM/FFF) were down –40% while those of vat photo

printers were up 18%.

Full–year shipments of Professional material extrusion printers

were down –37% YoY. Vendors of these machines, led by Raise3D and

UltiMaker, continued to lose ground to Entry–level price class

upstarts such as Bambu Lab.

While the material extrusion portion of this

category struggled again in 2024, vendors leveraging vat photo

technologies conversely reinvented themselves in 2024, resulting in a

reinvigoration of the sub–category. Leading OEMs shifted attention

away from laser and DLP–based solutions and towards masked

stereolithography, offering products leveraging new versions of this

process at similar prices to those using legacy technologies. Formlabs

and dental–centric SprintRay, industry leaders in this sector, saw

significant YoY shipment growth in Q4 2024 and helped push the market

split to 67/33 in favour of vat photo printers from the 50/50 share

with material extrusion printers just a year ago. These two companies

also led the way over the year as a whole: Formlabs shipped 29% more

machines in 2024 than in 2023, contributing to a 13% YoY rise in

global vat photo printer shipments.

Entry–level systems

Demand for Entry–level printers overall increased

significantly in 2024 and shipments for the full year rose 26% over

2023. However, all of the growth came in the first half of the year.

New vendors like Bambu Lab really struck a chord – not only with

consumers, but also with business users who shifted down from higher

priced products (especially the material extrusion printers that were

formerly the mainstay of the Professional price class).

Sales began to slow in this hot segment in Q3

2024 and growth turned negative in Q4 2024 when shipments fell just

shy of a million units for the quarter and –10% fewer printers

shipped globally compared to Q4 2023. Creality remained the

market–share leader (with a 40% share) but saw unit shipments drop

–25% YoY. Conversely, even while struggling with some negative press

toward the end of the year, the number two player (with a 20% share)

Bambu Lab saw their quarterly shipments rise 76%. Another bright

spot in this segment was growth for long–term player Flashforge

which saw shipments rise 77% as it continued to transform itself yet again.

Of all Entry–level 3D printers sold in the world,

in 2024, 96% came from Chinese vendors. A few minor players had

shifted some production to the US (the largest end–market for this

price–class), in anticipation of tariffs, but the economics of

producing such low–priced products in places where wages tend to be

much higher made such wholesale shifts in production not–yet–tenable

in 2024.

Outlook

Across the globe, big and small companies alike

have already hit all–important milestones this year: EOS shipped its

5,000th printer, Eplus3D its 100th “super–meter” metal PBF machine,

Xact Metal its 150th machine and Nikon SLM Solutions has produced its

1,000th metal PBF machine (and 50 of those are NXG large format

multi–laser systems!). The start of 2025 also saw new equity

investments including $120M for Stratasys, new investment for Velo3D,

the acquisition of Desktop Metal by Nano Dimension (which also has the

acquisition of Markforged on the horizon). The hope is that these

activities will bring new stability and profitability to the market as

it waits for the strong, pent-up demand reported by manufacturers of

Industrial AM systems to be let loose. The industry is no stranger to

such surges, having seen YoY shipments of Industrial systems jump 30%

YoY in 2021 after Covid lockdowns across the globe were lifted.

At the high end of the market, there is

anticipation of new demand developing due to global onshoring

initiatives, and that capital equipment expenditures will accelerate

again when interest rates drop. The timing of such interest rate drops

is the great unknown, and the situation is further complicated by

sticky inflation, tariff wars and M&A questions, especially in the US.

With major headwinds like these across the entire

AM market – and coming off a challenging Q4 2024 – CONTEXT notes that

forecasts have largely been shift–out with expectation now for flat to

single–digit unit shipment growth in 2025, mid–double–digit growth in

2026 and accelerating beyond that. Even with expectations for 2025

revised down, some pockets of excitement are anticipated in the year

ahead. M&A will again dominate the headlines but, more

importantly, there are glimpses of new models on the horizon which

could be of interest to 3D printing industry players and mainstream

audiences alike. For instance, we may see a low–priced (~$3,100)

full–colour material jetting printer come to market. Such a machine

has the potential to disrupt many different price classes, including

the Professional and the Midrange, and usher in a new age of innovation.